Insurance

Life Insurance

Life Insurance Claim Process & Requirements

The life insurance policy offers financial security to individuals and families in case of any unfortunate events like death and disability to the life assured. It is suggested that individuals should avail life insurance policies of such insurers, which offer a high claim settlement ratio with easy documentation.

Here we’ll discuss life insurance claim process and documents required for settling the claims.

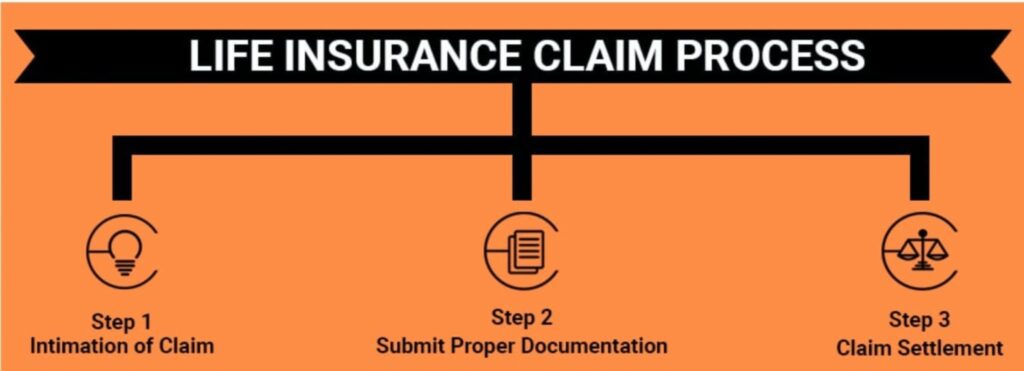

Life Insurance Claim Process

Life Insurance can be classified into three categories, i.e. Death Claims, Maturity Claims, and Rider Claims.Life insurance claim

benefits are entertained by the nominee, in case of the untimely demise of the life assured. Let’s discuss all three in detail.

1. Death Claims

1. Intimation of Claim

The nominee should intimate about the claim in written form to the insurance company as early as possible. The details should consist of the policy number, name of the insured, date of death, place of death, name of the claimant, etc. The nominee can avail the claim intimation form by visiting the nearest branch of the insurance company or can download from the official website of the insurance provider.

2 Submit Proper Documentation

To get your claim settled easily, it is required that you should submit your relevant documents. The nominee will be asked to present given below documents to the insurer:

- Death Certificate

- Age of the Insured (Birth Certificate)

- Original Policy Document

- Any other documents requested by the insurer

3 Claim Settlement

The insurer needs to settle the claim within 30 days of receipt of all documents submitted by the insured. However, there might be a case where an insurer requires further investigation. Under this scenario, the insurer has to complete its procedures within six months from the date of receiving the

written intimation of claim.

Life Insurance Companies

Compare and buy the most suitable Life Insurance Plan from the below-mentioned IRDAI-approved Life Insurance companies

Documents Required for Claim Process

Mentioned below are some of the important documents that are generally asked by the insurance company in settling the claims:

- Duly filled in and signed claim form

- Original policy certificate

- Death certificate issued by the local authority

- FIR

- Post-mortem reports

- Hospital discharge summary

- KYC documents (like a copy of photo ID and address proof) of a beneficiary

- Copy of cancelled cheque and bank statement

- If the claim is made by someone other than the nominee or assignee, the person making a claim has to submit legal proof of his or her title

- Life Insurance is considered one of the best options when it comes to securing your future needs. It should be noted that while settling the claims, the claimant must read the terms and conditions properly and submit all the relevant documents required for solving the claims. Failing in doing so will result in delayed claim settlement.

Life Insurance is considered one of the best options when it comes to securing your future needs. It should be noted that while settling the claims, the claimant must read the terms and conditions properly and submit all the relevant documents required for solving the claims. Failing in doing so will result in delayed claim settlement.